TL; DR

Another year, another holiday shopping season, and the growth continued.

Last year, Black Friday online sales grew 10.2% and Cyber Monday rose 7.3%. This year kept that trend going, but the way shoppers moved through the week looked a little different.

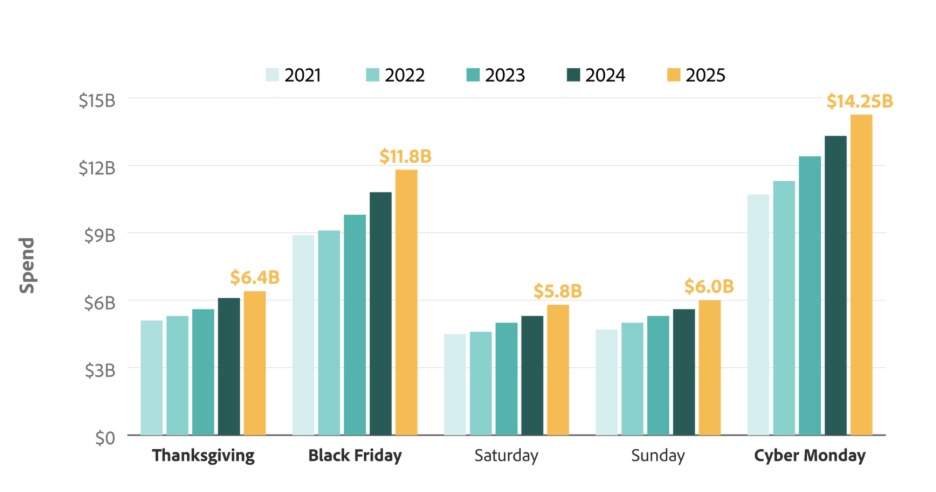

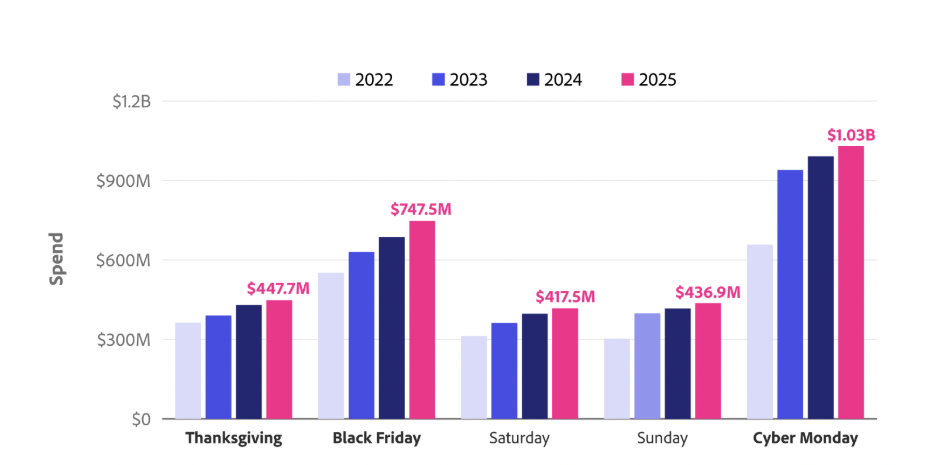

Across Thanksgiving and the weekend, Cyber Week reached $44.2B, up from $41.1B in 2024, a 7.7% YoY increase. Black Friday also performed strongly at $11.8B, growing 9.1% YoY and outpacing Cyber Monday for the 2nd year in a row.

Across Thanksgiving and the weekend, Cyber Week totaled $44.2B, which shows shoppers spread their purchases across the full 5-day window rather than concentrating on a single peak moment.

What stood out more than the totals was the behavior behind them. People shopped earlier, reacted quickly to deeper category discounts, used mobile checkout more often, and relied on BNPL more than ever, setting a record.

AI-assisted browsing and social discovery also played a larger role in how shoppers decided what to buy.

Now that we know the top-line performance, let’s take a deeper look at how people actually shopped this year and what patterns shaped the season.

When you look at the numbers side by side, the dynamic between the two days becomes clear. Cyber Monday still delivers the largest online volume, but Black Friday is growing faster and pulling more activity into the earlier part of the week.

Cyber Monday remains the biggest day

Most shoppers came in with a plan and closed out bigger tech purchases. The evening rush stood out as people compared prices, checked specs, and completed heavier carts. Cyber Monday still feels like the “decision day” where shoppers wrap up the items they’ve been watching all week.

Black Friday pulled in earlier momentum

Black Friday captured the shoppers who didn’t want to wait and were ready to buy as soon as the price dipped into their comfort zone.

The 5-day window worked like one connected cycle

Thanksgiving opened the week with $6.4B, higher than any of the previous four years, which helped pull shoppers in earlier.

Saturday and Sunday both rose to their highest levels in the five-year range. In older seasons, the weekend usually dipped as shoppers paused before Cyber Monday. This year, the drop never came. Weekend spending held strong, almost matching the weekday lift, which means shoppers stayed active at every point in the cycle.

Cyber Week didn’t just increase the number of purchases. The discounts were strong enough to change what people bought. Instead of sticking to entry-level options, shoppers moved toward higher-priced versions across almost every major category.

Electronics jumped the moment prices fell

Electronics hit 31% off, the deepest discounts of the week, and demand took off immediately. Shoppers didn’t wait or compare endlessly. They grabbed upgraded versions:

Toys and apparel stayed hot because the discounts were simple

Toys sat at 28% off, a clean holiday discount that parents reacted to fast. Even after Cyber Monday, toys held at 23% off, which kept the category moving through early December.

Apparel followed the same pattern:

Home appliances, and furniture benefited from quiet but steady cuts

These categories didn’t have flashy discounts, but 19% off was enough to nudge shoppers into bigger purchases.

Season-to-date data shows the shift:

These are not impulse buys. But when prices dropped and stayed predictable, people went for the better version like the fridge with more features, the nicer coffee machine, the upgraded cookware.

Across electronics, apparel, toys, TVs, appliances, and furniture, discounts hovered between 15% and 19% well into the first week of December. That kept shoppers buying instead of stepping back after Monday.

Mobile has been climbing for years, but Cyber Week 2025 pushed it into clearer territory. Phones weren’t just the place people browsed. They became the place people finished their purchases.

Cyber Monday confirmed the shift

For the first time, a majority of Cyber Monday orders came from mobile:

Five years ago, mobile held just 41.4% of Cyber Monday sales.

Thanksgiving set a new high

Thanksgiving saw 61.6% of sales on mobile; the strongest share yet. This used to be a browsing-heavy day, but the friction between browsing and buying has disappeared. Shoppers no longer wait to switch devices before checking out.

Desktop still holds its place but for different reasons

Even with mobile taking most of the volume, desktop kept its role:

Desktop didn’t lose relevance. It simply became the tool for shoppers who wanted more control before committing.

Cyber Week showed how much shoppers now rely on flexible payments. Buy Now Pay Later didn’t just grow, it hit a new milestone and became a major driver of bigger baskets, especially on Cyber Monday.

Cyber Monday broke the BNPL record

BNPL usage reached its highest point ever:

Cyber Monday has always been the “big purchase” day, and BNPL amplified that behavior. Shoppers used it to lock in the items they had been monitoring all week.

BNPL is overwhelmingly mobile-first

Almost all BNPL orders happened on phones: 79.4% of BNPL transactions were completed on mobile

This aligns with the broader mobile shift across Cyber Week, but it also shows how natural BNPL feels in a mobile checkout flow. A few taps, and the purchase fits the budget.

What shoppers used BNPL for

Adobe’s consumer survey adds more clarity. Shoppers leaned on BNPL for categories where prices stack up quickly: Electronics, Apparel, Toys, Furniture. These are exactly the categories where larger carts are common and BNPL helped close the gap between intent and decision.

Cyber Week 2025 wasn’t just shaped by discounts. It was shaped by how shoppers found those discounts. AI tools and social feeds played a much bigger role in guiding decisions, especially during Cyber Monday’s peak hours.

AI-powered shopping tools saw explosive growth

Shoppers increasingly used generative AI chat services and browser tools to compare prices, find deals, and evaluate products. The lift was dramatic:

AI-driven traffic to retail sites jumped 670% on Cyber Monday

The base is still modest, but the growth curve isn’t. Shoppers turned to AI most for categories like:

AI functioned as a real-time shopping assistant, surfacing the best prices, explaining differences between models, and helping shoppers cut through the noise.

Social media became a major revenue driver

Social wasn’t just part of the discovery journey. It started converting.

This is one of the biggest spikes Adobe has reported for social-driven purchases during Cyber Week.

Shoppers didn’t only search for deals. They let creators, reviewers, and short-form video demos guide what to buy.

Traditional channels still matter but the shift is clear

Paid search and email remained consistent, high-performing channels.

But consumers are increasingly leaning on:

The journey has become less linear and more exploratory.

All these numbers make one thing clear. Black Friday and Cyber Monday may sit in the same five-day window, but shoppers didn’t use them the same way. Black Friday carried the early momentum, Cyber Monday closed out the bigger decisions, and the rest of the week stayed active enough to blur the old peaks.

And it does make you wonder: If AI just entered the picture and already shifted behavior, how far will it reshape Cyber Week next year?